Disclaimer: This is not legal, tax, or financial advice. Please consult with your attorney or tax advisor before making any financial decision.

Basic Information

• There are currently 5 main programs available:

Paycheck Protection Program (PPP)

Refundable Employee Retention Credit

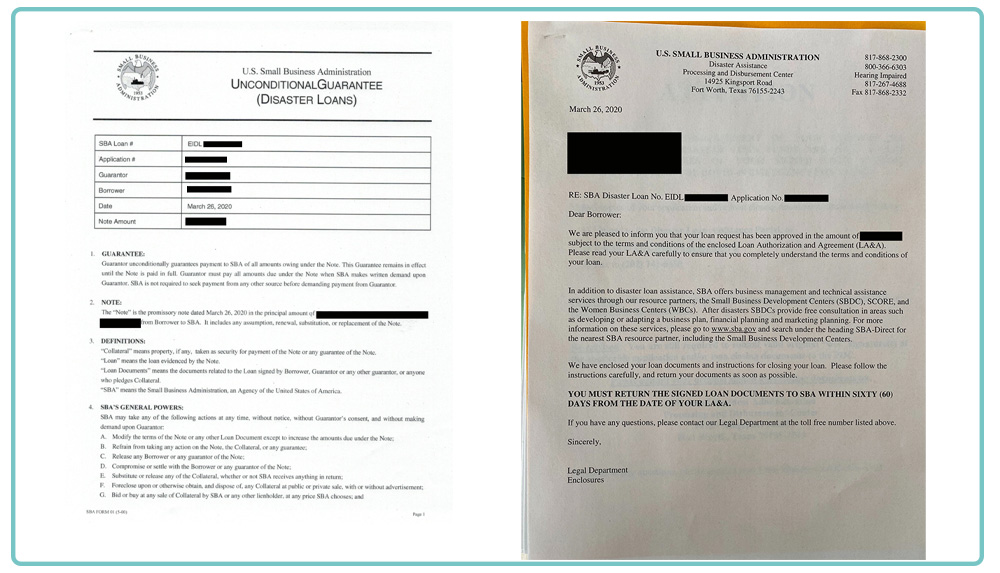

Economic Injury Disaster Loan (EIDL)

Emergency EIDL Grants

Emergency Family and Medical Leave

• Payroll Protection Program (PPP)

The PPP officially launched on Friday, April 3. This new loan program from the federal government is designed to help small business owners affected by the coronavirus pandemic obtain funding to cover payroll, rent, and other obligations.

Although the program is being administered by the SBA, the loans themselves will be disbursed by the nation’s banks, credit unions, and other federally approved lenders. That means small business owners need to apply for funding with their local and/or existing banking partner.

Not every bank is ready to accept applications and approve loans at this moment in time. Some major national banks are up and running with the PPP, while others are still finalizing their processes.

In addition, you likely won’t be able to walk into any bank and ask for a PPP loan. Most banks will require that you have an existing relationship with them and/or ask you to meet other requirements.

• PPP Overview

• Where to Apply for PPP Loans

National Banks

Regional and Local Banks

Credit Unions and Non-Bank Lenders

• Required PPP documentation varies from bank to bank. Here are some common ones:

• IRS Quarterly 940, 941 or 944 payroll tax reports for 2019

• Monthly payroll reports for 2019 (Must show the following:)

Gross wages for each employee

Paid time off for each employee

Vacation pay for each employee

Family medical leave pay for each employee

State and local taxes assessed on the employee's compensation for each employee

• 1099s for 2019 if you are applying as an independent contractor

• Documentation showing total health insurance premiums paid by the company under a group health plan

• Document the sum of all retirement plan funding that was paid by the company.

• Business entity documentation (e.g. operating agreement, certificate of organization, bylaws, articles of incorporation)

• 2017, 2018 and 2019 business tax returns, if applicable, and 2019 internal financial statements if 2019 tax return is not filed

• 2020 interim financial statements (balance sheet, income statement, accounts receivable aging and accounts payable aging)

• Debt schedule for operating business

• List of owners of the business if not included in the tax return

• Copy of driver's license for signers of business. (This is likely for 20%+ owners)

• EIDL Documentation:

SBA Loan Application (SBA Form 5 or 5C)

Tax Information Authorization (IRS Form 4506T)

Complete copies of the most recent Federal Income Tax Return

Schedule of Liabilities (SBA Form 2202)

Personal Financial Statement (SBA Form 413)

Contact Information

• SBA Disaster Desk

Website: disasterloan.sba.gov

Phone: 1-800-659-2955 (TTY/TDD: 1-800-877-8339)

Email: disastercustomerservice@sba.gov

SBA Loan Processing Center (Post-Approval) – 1-817-868-2300

• System for Award Management (Information on a company's SBA Profile is imported from the System for Award Management (SAM), so any updates should be made there.)

Tips

• Best time to call SBA – Weekends, especially Sundays

• Escalating your request - Email if you are not able to get through customer service. If your loan is approved but your case manager is not helping you promptly, ask the operator for the team lead

• Refinancing - PPP can be forgiven. Refinance your EIDL to a PPP

• Personal guarantee for loans above $200K - get your spouse’s approval

• The loan application needs wet signatures. Overnight to Fort Worth processing center

• As of Apr 10th, SBA loan officers have not been able to review application numbers starting with 3xxxxxxxxxxx

• EIDL is not a single-step process. First, your loan officer will review your application and will request more documentation if needed. Second, your loan officer will approve or deny the application. If your application is approved, it will be assigned to a case manager to get closing docs from you, which typically includes executed loan documents, UCC-1 Filing, etc.

• PPP too is a single-step process. Please expect something of the above nature thought it should be slightly faster given the process was delegated to banks and SBA lenders. As of Apr.13th, it appears so from anecdotal evidence that the smaller banks are responding faster than the larger banks

PPP & EIDL FAQ

• I am a sole proprietor/own an LLC and pay myself through an owner draw. Do I still qualify for this loan?

» We think so. This is TBD based on SBA guidance however, and may come down to whether your owner draw is considered wages or not. It would not surprise us if the definition comes down to which part of your draw you pay self employment tax on, but this has not been decided.

• My team are independent contractors, nobody is on W2. Can I count payments to independent contractors as part of payroll?

» The latest guidance from Treasury/SBA says that independent contractors are eligible for their own PPP, so do not count as part of payroll.

• I’ve seen a lot of Twitter noise about “affiliation rules” and that anyone who has taken investment may not qualify. Is that true?

» This would likely only apply to situations where you no longer have control over your business (aka you sold so much of it someone else controls it). The intent of that rule is to avoid scenarios where a huge company claims all its wholly owned subsidiaries as “small businesses”.

• How long until I see any cash from this?

» Hopefully very quickly, but unknown, as these are administered through banks that are able to issue SBA 7(a) loans. We would expect anyone who has an existing relationship with an SBA lender to get cash first. However, it is definitely worth reaching out to your existing bank now, even if they don’t traditionally do SBA loans.

» If you are in dire straits for immediate cash, please pay attention to the “Emergency EIDL Grants”.

• I am a new business and haven’t been operating for 12 months. Am I screwed?

» No. If you were not in business between February 15th, 2019 and June 30th, 2019, then you can elect to use the average between January 1st, 2020 and February 29th, 2020.

• I just fired someone/cut salaries, did I lose out on the loan forgiveness?

» No, the headcount and salary reduction items only start counting 30 days after the enactment of the CARES Act, so you can re-instate salaries/re-hire until then.

• If I hired a bunch of people throughout the last 12 months, can I let them go just so long as my average headcount is higher than it was last spring?

» Well... The loan forgiveness looks at the headcount in the period Feb 15th - June 30th, 2019, and if it’s more than that during the Covered Period, then you can cut. However, keep in mind that the loan can only be used to cover specific expenses, so there’s probably no benefit to doing this.

• I keep hearing the term “Covered Period”. What does that mean?

» The Covered Period is February 15th - June 30th 2020.

• Can I take out a new loan/mortgage and have interest payments be covered by this?

» No, loans must have been originated before February 15th, 2020.

• When will this program become available? How long can I apply for?

» Starting April 3, 2020, small businesses and sole proprietorships can apply for and receive loans to cover their payroll and other certain expenses through existing SBA lenders.

» Starting April 10, 2020, independent contractors and self-employed individuals can apply for and receive loans to cover their payroll and other certain expenses through existing SBA lenders.

» Other regulated lenders will be available to make these loans as soon as they are

» The loan must be made (originated) in the Covered Period (so before June 30th 2020)

• How to do UCC-1 filing as a precondition to get funds above $25K disbursed to you?

» UCC filing is a type of lien on your business assets that a creditor files to give notice that it has an interest in the personal or business property of a debtor. Usually, SBA would file this themselves but because of staff shortages, they are asking you to do the filing on their behalf and provide proof before disbursement of funds over $25K. You would need to do this on your state’s Secretary of State website and there is typically a small fee associated with it.

Special thanks to Fundera (www.fundera.com), Eksperten (www.eksperten.com), and MicroConf (www.microconf.com) for contributing heavily to this reference guide.